idaho estate tax return

In Idaho every resident who must file a federal income tax return is also required to file a state tax return. If you have questions about either the estate tax.

Small Estate Affidavit Proceeding 2.

. Object Moved This document may be found here. The Illinois Estate and Generation-Skipping Transfer Tax Act 35 ILCS 4051 et seq. The Idaho tax filing and tax payment deadline is April 18 2022.

Most homes farms and businesses are subject to property tax. Idaho has no estate tax. The amount is based on the most recent approved 2019 tax return information on file at the time the rebate is issued.

We must manually enter information from paper returns into our database. In regards to an estate tax your estate is defined by the total of your debts and possessions that are left behind when you die. According to Idaho State Tax Commissions website you can expect to receive your refund in about 7 weeks from the date you receive your state acknowledgement for e-filing.

If an amended Federal Estate Tax Return is filed an amended Idaho Estate and Transfer Tax Return must immediately be filed. Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. But seniors also can qualify for a property tax break if they own and reside in a home with less than 1 acre of property and have income below a certain threshold.

E-Filing non-resident ID state returns is not available. For paper filing it can take up to 10 weeks for your refund to complete processing. Find IRS or Federal Tax Return deadline details.

If the last day for filing any return falls on a Saturday Sunday or legal holiday the return is on time if it is filed on the next work day. Include a complete copy of your federal income tax return with your Idaho fiduciary income tax return. 12 weeks for paper returns filed after April 1st.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1158 million in 2020. The decedent and their estate are separate taxable entities.

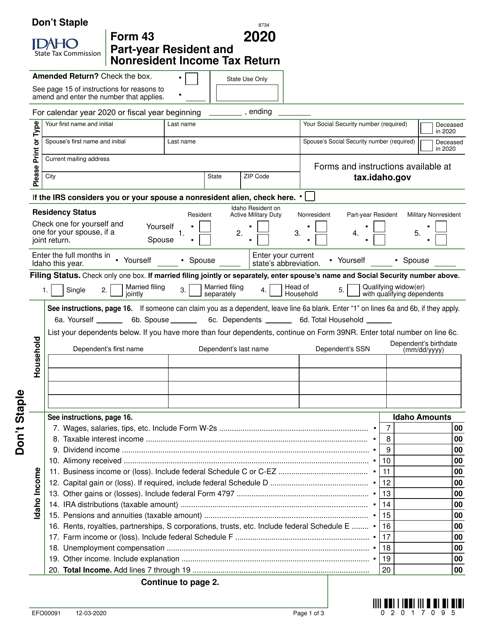

Non-resident ID state returns are available upon request. Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last tax year of a decedent or for a beneficiary of a guardianship trust or estate. To fully understand the differences between these two types of taxes its important to first understand what each tax entails.

All of these debts must be paid off. Until that time well report your return as not entered in system Add those three weeks to the estimates above to determine your refund timeline. Before filing Form 1041 you will.

Opening the Estate-Formal-Testate or Intestate 5. Taxes are determined according to a propertys current. Preparation of a state tax return for Idaho is available for 2995.

PROBATE CHECKLISTS 1. Estate Tax Section 500 South Second Street Springfield Illinois 62701 Telephone. 217 524-5095 Messages left on the estate tax lines will be monitored and callers will receive a response as soon as possible.

Differences Between Inheritance and Estate Taxes. Within 180 days of receiving this return the Idaho State Tax Commission may discuss this return with the paid preparer identified below. If the Idaho Fiduciary Income Tax Return Form 66 is filed within the.

Idaho State Income Taxes for Tax Year 2021 January 1 - Dec. Its one of the following whichever is greater. A copy of the Federal Estate Tax Return approved extensions copy of the will copy of any trust agreements and all attach-ments required to be filed with the Federal Estate Tax Return must be filed with this return.

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the. Fiduciary Estate - April 15 - Returns are due by the 15th day of the fourth month following the close of the taxable year. 50 per taxpayer and each dependent 9 of the tax amount reported on Form 40 line 20 or line 42 for eligible Idaho residents and service members using Form 43.

Administration-Probable Court Matters 6. Appointing a Special Administrator 3 Opening the Estate -Informal -Testate or Intestate 4. Direct Deposit is not available for Idaho.

Idaho has progressive state income tax rates that will range up to approximately 7. Property taxes in Idaho are on the low side. In addition part-year residents with more than 2500 in.

E-File is not available for Idaho. If your estate is large enough you still may have to worry about the federal estate tax though. There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022.

It takes about three weeks to enter new filers into our system. IRS Form 1041 US. Idaho State Tax Commission PO Box 56 Boise ID 83756-0056 Include a complete copy of your federal Form 1041.

See the Idaho Individual Income Tax booklet for filing requirements. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Idaho sales tax is 6.

Closing the Estate-Small Estate Summary Proceeding 7. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ID state return. With thorough estate planning and proper legal maneuvering Idaho tax laws allow any resident to protect up to 1206 million worth of estate from the Federal Death Taxes However depending on the actual worth of your estate and the number of heirs the procedure may take decades.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Idaho Estate Tax Everything You Need To Know Smartasset

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Understanding The 1065 Form Scalefactor

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Filing An Idaho State Tax Return Things To Know Credit Karma Tax

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Idaho Estate Tax Everything You Need To Know Smartasset

You Made A Mistake On Your Tax Return Now What

How To File Taxes For Free In 2022 Money

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset