maryland digital advertising tax proposed regulations

The distinction is clever but not particularly compelling and there is legal precedent for invalidating laws requiring tax collections by. T 1 215 814 1743.

Tax Foundation Comments on Marylands Digital Advertising Tax Regulations.

. Posted In AllocationAppointment Constitutional Issues Maryland Nationwide Importance Procedure. Regulations01 through06 under code of maryland regulations comar section 031201 the proposed regulations which aim to provide guidance on the digital advertising gross revenues tax the tax. Proposed digital advertising tax regulations were filed on August 31 by Marylands comptroller.

Marylands Digital Advertising Tax Is Unworkably Vague. General guidance on the tax. The rate of tax is determined based on the persons global annual gross revenues.

03120102B Proposed Regulation outlining how the states new tax on gross revenues from digital advertising services DAT will operate. Marylands position has not been to deny the thrust of PITFA but to hope that courts will adopt a saving interpretation that concludes that the tax is really on contracts for digital advertising and not the advertising itself. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021.

The DAT is currently scheduled to take effect on January 1 2022 and will. Overriding the governors veto of HB. But legislators punted several crucial questions to the state comptroller who last week submitted proposed regulations for the digital advertising tax to the state Joint.

For persons with global annual gross revenues of 100 million through 1 billion the tax rate is 25 of the assessable base. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country. On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md.

In the December 3 2021 issue of the Maryland Register the Comptroller confirmed that it adopted regulations to the Digital Advertising Gross Revenues Tax on November 24 2021Despite robust comments provided to the proposed regulations including those provided by Eversheds Sutherland the Comptroller made almost no changes in the final version. One of the provisions the Act states that the applicability of the Digital Advertising Gross. Digital advertising revenues sourced to Maryland of 1 million or more.

031201 General Regulations Subtitle 12 DIGITAL ADVERTISING TAX 031201 General Regulations Subtitle 12 DIGITAL ADVERTISING TAX 031201 General Regulations Authority. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. First traditional advertising is not taxed in Maryland only digital advertising which is likely in violation of the federal Internet Tax Freedom Act which protects online businesses from punitive or discriminatory taxation.

Tax-General Article 2-102 2-103 75-102 Annotated Code of Maryland Notice of Proposed Action The Comptroller of Maryland proposes to to adopt new Regulations 01 through 06 under. Given the dynamic pricing of most online advertising with rates calculated on the basis of the demographics of the chosen advertising universe such as age sex geography interest and purchasing patterns passing along the costs of the tax to the advertisers themselves would be trivial for most advertising platforms even if lawmakers also passed. In order to be subject to the tax a taxpayer must have 100000000 in global annual gross revenue and 1000000 of.

On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on October 8 2021. For persons with global annual gross revenues of over 1. And clarification on the tax filing requirements.

732 2020 the Maryland Senate on February 12 2021 passed the nations. Three Issues with Proposed Regulations for Marylands Digital Advertising Tax. Wednesday March 17 2021.

Applicability Date of Digital Advertising Gross Revenues Tax Delayed On April 12 2021 the General Assembly of Maryland passed Senate Bill 787 an Act concerning Digital Advertising Gross Revenues Income Sales and Use and Tobacco Taxes Alterations and Implementation. Maryland Digital Advertising Tax Litigation Focus Moves to State Courts. Second the application of a threshold related to global revenues may violate the Commerce Clause as it results in a higher tax rate for multistate or.

On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on Administrative Executive. Per the Maryland Administrative Procedure Act the final adopted. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan.

2 The regulations provide a set of rules for. In simple terms the proposed regulations would require companies that derive revenue from residents of Maryland as a direct result of those residents responding to digital ads running in Maryland to report the revenue derived from such ads which would then be subject to a tax. The Maryland comptroller of the treasury has proposed to adopt new regulations regarding the digital advertising gross revenues tax to provide guidance on the state from which digital advertising services are derived.

Tax Rules For Claiming Adult Dependents

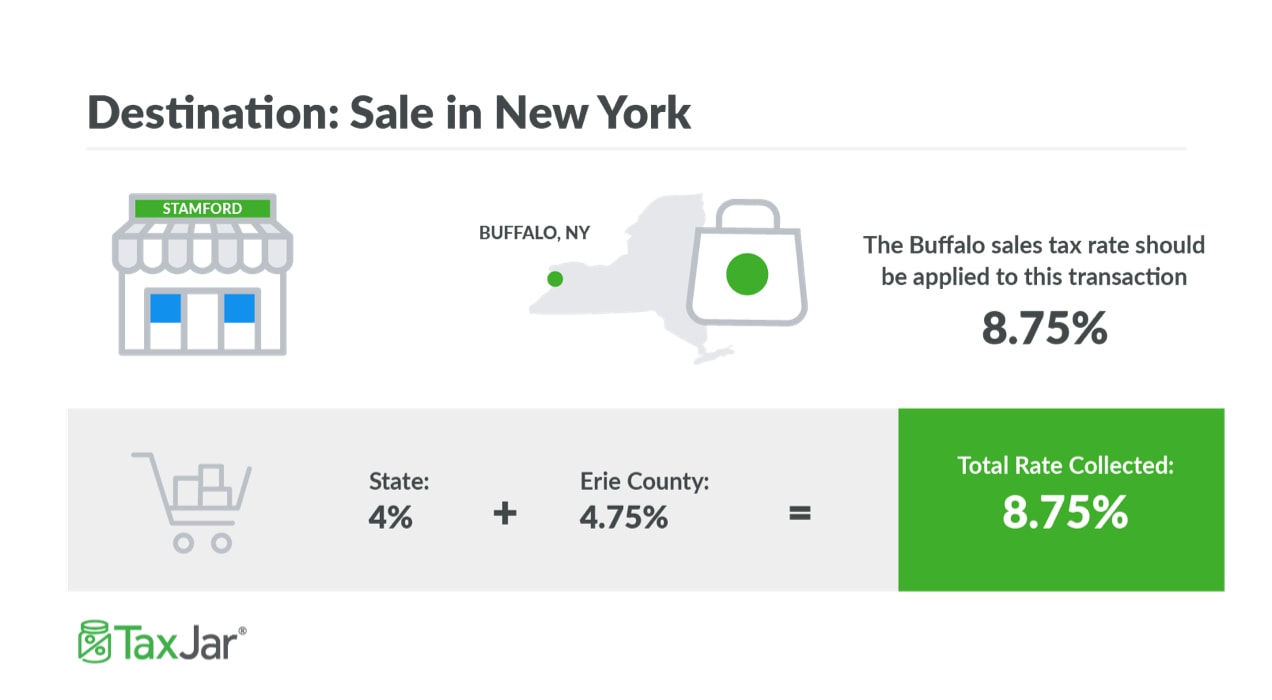

How To Charge Your Customers The Correct Sales Tax Rates

Why Businesses Incorporate In Delaware Infographic Delaware Business

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Amp Pinterest In Action Contract Template Business Business Template

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Content Marketing For Law Firms It S Important And Video Can Help Leggende Cose

Original Promotional Flyer For Judy Garland S Appearance At Carnegie Hall Broadway Posters Judy Garland Judy

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Consult Business Consulting Html Template Consulting Business Finance Templates

How Toys R Us Went Bankrupt Wsj Youtube Toys R Us Toys Top Toys

Free General Accountant Job Ad Description Template Google Docs Word Template Net Accounting Jobs Job Ads Job Description Template

レンタル携帯の利点 需要大の連絡service Website Traffic Best Online Business Ideas Internet Business

The Small Business Checklist Visual Ly Graficos De Informacion Pequena Empresa Infografia